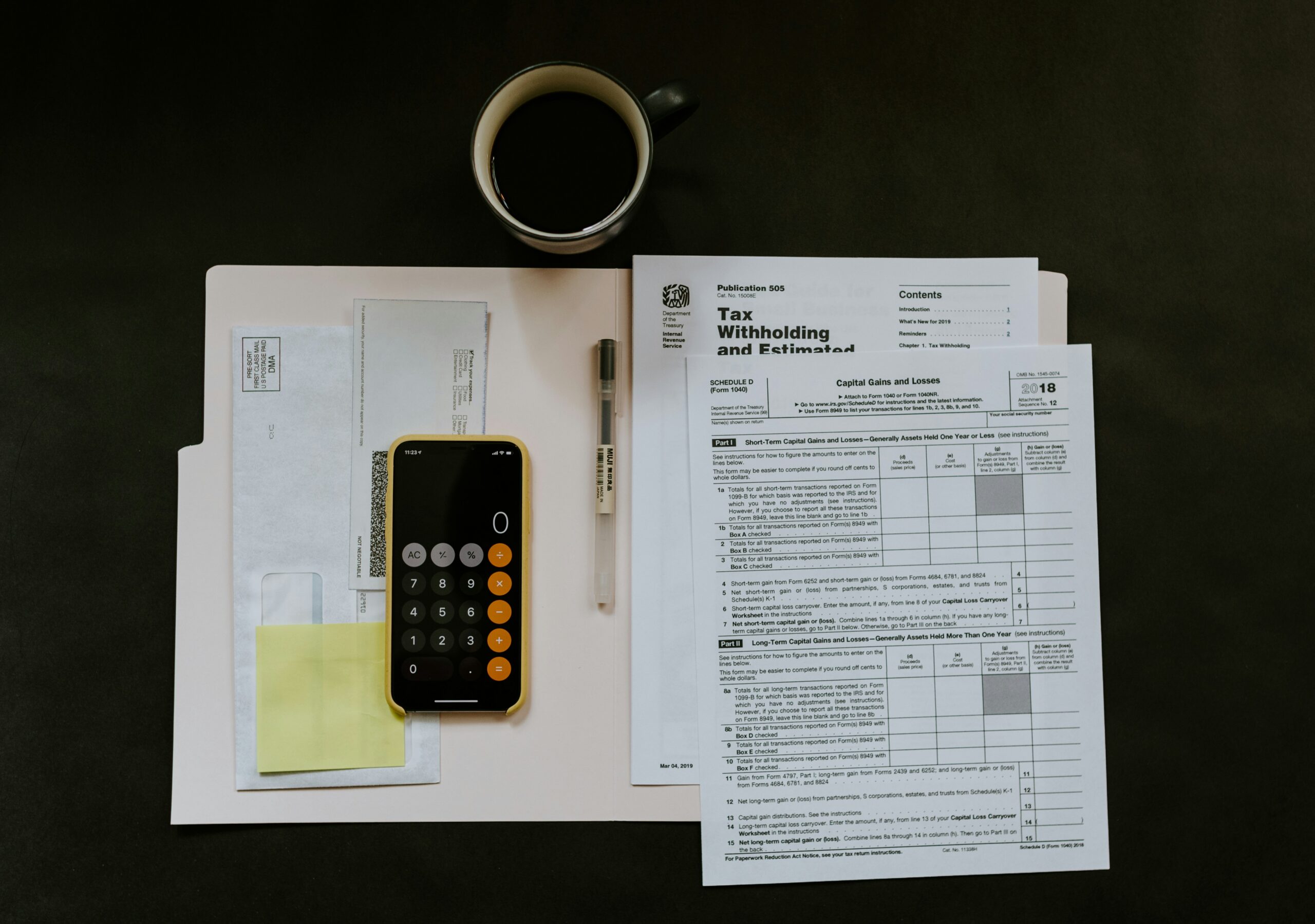

Unlock the potential for seamless tax compliance with our array of specialized solutions. From Voluntary Disclosure Agreements (VDAs) to meticulous State Tax Consulting Services, and comprehensive Sales and Use Tax Services, we offer unparalleled expertise to streamline your tax processes. Discover how our expertise can transform your tax compliance processes. Learn more about our services today.

What We Offer

Our Portfolio Company Services

Voluntary Disclosure Agreements

A voluntary disclosure agreement (VDA) is an agreement between an entity with undisclosed tax liabilities for income, franchise, gross receipts, sales and use, property, or other taxes and state and/or local jurisdictions. This agreement limits lookback periods and generally waives penalties in exchange for voluntarily disclosing and remitting taxes and interest for a certain period. The VDA process involves complex issues that require an in-depth knowledge of procedures to ensure compliance.

State Tax Services

With three decades of state tax experience at your disposal, we provide on-call Big 4 quality State Tax Consulting Services to regional accounting firms and private equity portfolio companies, so they have the deep technical state tax experience that they need. Whether it is state tax issues on mergers and acquisitions, nexus studies, taxability studies, apportionment issues, state tax audit defense, or complex state income/franchise and non-resident withholding matters, our team is ready to help your clients. We provide our services on an hourly rate basis at fraction of the large firms.

Sales and Use Tax Services

Sales and use tax compliance requires a business to prepare, file, and pay taxes to each jurisdiction, with monthly, quarterly or annual filings. A business must consider the product and service being sold, the tax rate where the customer is receiving the product and service, the terms of the contracts, and the invoices. Additionally, proper compliance needs to consider the location of the customer to insure whether the transaction is taxable in that jurisdiction, what the proper rate of tax is for the locality and what is the proper jurisdiction in which to report the sale.

Contact Us

Let us help you.

At Insight Tax Advisors, we understand that tax related matters can have a significant, and often confusing, impact on a pending transaction. Our dedicated team of tax experts is here to help you find the solutions you need. Whether you are buying or selling, or even just contemplating a long-term exit strategy, we have you covered.

Simply click the button below, and let’s start a conversation. Your financial clarity and peace of mind are just a message away.